Bridging the Gap: Unpacking ESG Goals for Real Estate Success

Hello, Kevin Dollhopf here. In our rapidly evolving business landscape, corporate Environmental, Social, and Governance (ESG) goals are gaining traction, profoundly impacting real estate portfolio management and location strategy. But here's the thing - there's often a disconnection between ambitious ESG objectives and their actual implementation. That's why our comprehensive ESG report is such a vital tool.

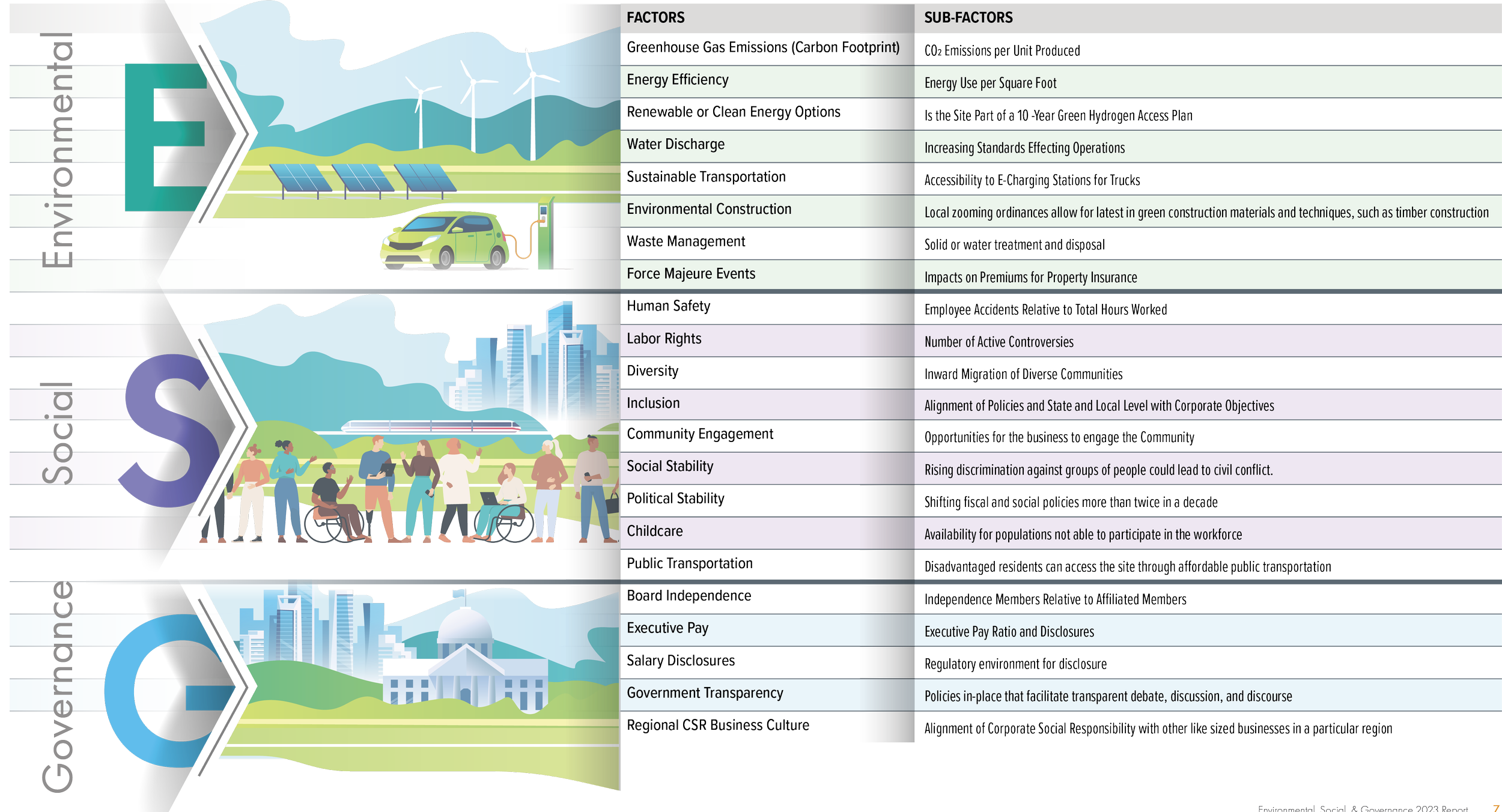

Understanding the ESG Report

The report details a process for analyzing and scoring real estate facilities and portfolios, creating actionable plans that help bridge this gap between ESG vision and execution. It underlines how real estate is not just about physical assets; it's a tangible reflection of a company’s ESG culture. Grasping ESG goals allows real estate service providers, Economic Development Organizations (EDOs), and developers to deliver more value for clients. It also illuminates the significant government incentives available for executing ESG goals in facilities and site selection.

The Untold ESG Benefits

There's more to ESG than what's covered in the report. Commercial Real Estate (CRE) leaders can seize the opportunity to become prominent ESG advocates due to the substantial influence of facilities on ESG metrics. Engaging with a company's ESG program also gives executives a golden ticket to interact with a wide range of functional leaders, gaining insight into the overall corporate strategy. Moreover, recognizing that ESG is not a universal concept is another crucial point. Various regions and countries have unique ESG perspectives, making it important to understand local, regional, or country-specific ESG priorities when formulating strategies or choosing sites.

ESG for All: Not Just for Corporate Giants

Finally, we cannot overstate the importance of ESG discussions for companies of all sizes. Every organization, irrespective of size, can enhance their community role by championing ESG initiatives, improving their standing and contributing to overall success.

How Hickey Can Help with Your ESG Goals

So, how can Hickey help you navigate your ESG journey? We can support you in integrating your corporate ESG goals into your real estate transactions and portfolio management. Our expert team can assist you in unearthing additional cost savings related to ESG upgrades in your real estate - savings that you can reinvest in your ESG initiatives.

To kickstart this process, we offer a confidential, no-cost review of your portfolio to identify potential savings. We can also aid in developing new critical location factors based on ESG for your site selection, ensuring your choices are both business-smart and ESG-smart.

The Journey Towards a Sustainable Future

At Hickey, we're all about making your ESG journey as frictionless and rewarding as possible. Join us in taking those pivotal steps towards a more sustainable and successful future.

Ready for the next step? Click the button below to continue to the next page and download the comprehensive ESG report. Let's make your ESG goals a tangible reality together.